- 5 Bullet Fridays

- Posts

- 5 BULLET FRIDAYS - Tax Mechanic News, Tips & Strategies

5 BULLET FRIDAYS - Tax Mechanic News, Tips & Strategies

Welcome to Tax Mechanic Insights! 📬

🌟 Overview |

|---|

Welcome to your definitive newsletter for transforming tax troubles into triumphs. 💼 Whether you're managing personal or corporate taxes, our seasoned experts are here to guide you every step of the way. 🧑💼 Today's edition is brought to you by Tax Mechanic – your trusted partner in navigating the complexities of the Canadian tax system. 🛠️💡📊 |

Canada’s 2025 Budget to Introduce Automatic Tax Filing for Low-Income Households

Exclusive insight into Ottawa’s latest fiscal innovation.

Prime Minister Mark Carney has announced a transformative measure in Canada’s upcoming 2025 federal budget — the automatic filing of taxes for low-income Canadians. The initiative, led by the Canada Revenue Agency (CRA), will ensure that millions of eligible citizens receive the benefits they often miss due to unfiled tax returns.

By 2027, approximately 1 million Canadians will have their taxes filed automatically, with the figure expanding to 5.5 million by 2028. The program targets those who typically forego filing — not for lack of eligibility, but for lack of resources or understanding of its impact.

“Too often, the people who most need benefits don’t get them,” Carney said, underscoring the program’s equity-driven intent.

Key Benefits Affected

Benefit | Purpose |

|---|---|

GST/HST Credit | Offsets sales taxes for lower-income households |

Canada Child Benefit | Provides financial support for families with children |

Canada Disability Benefit | Assists individuals living with disabilities |

The automatic filing measure will be embedded in the November 4 federal budget and follows policy groundwork first explored in the 2023–2024 economic statements.

In addition, the budget will make the National School Food Program permanent, expanding access to 400,000 children and saving families up to $800 annually on groceries. The popular Canada Strong Pass, offering discounted access to museums, parks, and rail travel, will also return for the 2025 holidays and summer season.

Source: Global News

Dreams, Energy & Entrepreneurship: The Truth Nobody Tells You

In Episode 88 of Tea with GaryVee, entrepreneur Gary Vaynerchuk unpacks the truth about chasing dreams while juggling work, family expectations, and self-doubt. His message is clear: dreams aren’t given — they’re earned through relentless action.

Too many people, he argues, blame “draining jobs” for their lack of progress. The real problem isn’t the work — it’s the misalignment between effort and purpose. As GaryVee puts it, “Energy is endless when you’re chasing what excites you".”

Key Takeaways from Episode 88

Topic | Insight |

|---|---|

Knowing When to Quit | Differentiate between fatigue and misalignment. Quitting too soon kills momentum. |

Unlimited Energy at 23 | Youth isn’t about time — it’s about conviction and curiosity. |

Balancing Job & Dream | Use your 9–5 as the investor in your 6–11. Build stability while building passion. |

Investing in Startups | Everyday people can back ideas they believe in — ownership is democratizing. |

Insecurity & Awareness | Over-comparison is a modern epidemic; awareness without gratitude breeds scarcity. |

Vaynerchuk also shares candid reflections on women in entrepreneurship, early-stage investing, and the psychology of ambition — challenging listeners to replace excuses with self-awareness and forward motion.

Source: Tea with GaryVee Ep. 88

Unlocking the Power of Your Home Equity: Turning Potential into Financial Freedom

How a clear mortgage strategy can transform your home from an idle asset into a wealth-building tool.

Many homeowners take comfort in knowing they’ve built substantial equity — often $300,000 or more — assuming it guarantees financial security. But the truth is, equity without strategy is dormant capital. It sits quietly while you continue to shoulder rising expenses, tight budgets, and mortgage stress.

One homeowner I recently worked with had exactly that problem. Despite years of responsible payments, their monthly mortgage costs had become overwhelming. Their home was a goldmine on paper — yet it wasn’t helping them breathe easier.

The Power of a Mortgage Strategy

Strategic Step | Outcome |

|---|---|

Realign the Mortgage | Reduced monthly payments and immediate financial relief |

Leverage Home Equity | Access funds to invest, consolidate debt, or create new income streams |

Build for the Future | Set a faster path toward mortgage freedom and long-term stability |

By rethinking their mortgage, this client didn’t just lower payments — they activated their equity. What was once “dead weight” became an active financial asset, fueling investment opportunities and accelerating wealth growth.

✨ Contact Genelle Today

Genelle George |

📱 Call/Text: 416-854-7697 |

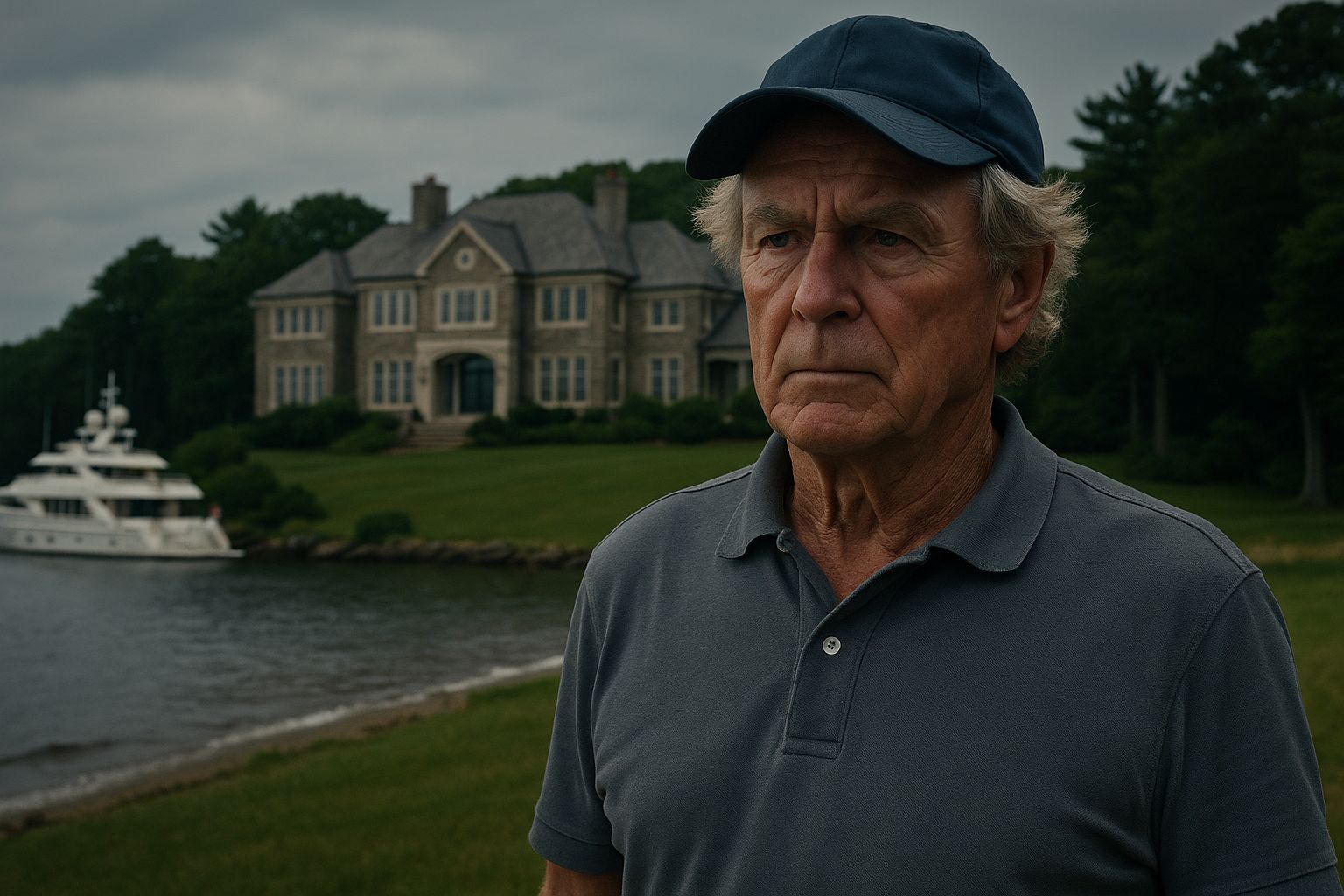

Inside John Risley’s $89 Million Tax Battle with the CRA

Few stories illustrate the clash between wealth, lifestyle, and tax law like the ongoing dispute between John Risley and the Canada Revenue Agency (CRA). The Nova Scotia entrepreneur — best known as the co-founder of Clearwater Seafoods — is contesting reassessments claiming he underreported $89 million in taxable benefits over two decades.

At its core lies a classic question: where does business end and personal benefit begin?

The CRA argues Risley’s companies funded personal luxuries — from a 16,000-square-foot seaside mansion to three yachts, a ski lodge, and equestrian operations — all deemed taxable benefits. Risley concedes about $33 million but disputes the rest, asserting the agency overvalued assets and misjudged business use. His appeals challenge both the methodology and fairness of the CRA’s approach.

Key Issues at Stake

Disputed Item | CRA Position | Risley’s Argument |

|---|---|---|

Seaside Mansion | Personal use funded via interest-free corporate loans | Used partly for charity and business functions |

Yachts | Personal luxury assets | Chartered vessels used to advance business interests |

Cattle & Horse Operations | Personal hobbies | Legitimate business ventures with promotional value |

Tax experts note that such disputes, while dramatic in scale, are not uncommon. The CRA routinely examines shareholder benefits, especially when corporate assets blend with personal lifestyles. Yet the evidentiary burden on taxpayers is immense: proving how a yacht, lodge, or estate was used decades ago can be nearly impossible.

Source: CBC News

From $55,000 CRA Bill to a Refund — How Tax Mechanic Made It Happen

In our latest TikTok video, Fraser shares an incredible client success story from Surrey, B.C.

Our client faced a shocking $55,000 tax bill from the CRA. Things escalated when the agency froze her bank account and withdrew $3,000, a stressful situation for anyone.

That’s when Tax Mechanic stepped in. After a thorough review of her finances, our team discovered a major error: her records actually showed a refund of $771, not debt.

We worked quickly to correct the CRA’s assessment and our client not only cleared the false balance but received her refund.

@taxmechanic How we saved our client $55k...in Taxes? That's how we do it.. BOOK A CALL TODAY - LINK IN BIO.

Quick Snapshot

Issue | Result |

|---|---|

CRA billed $55,000 | Corrected to $0 owing |

$3,000 seized | Funds recovered |

Tax return reviewed | $771 refund issued |

At Tax Mechanic, we don’t just fix numbers, we fight for fairness.

Need help now? 👉 Book a consultation / Contact us. Check our Google reviews to see client outcomes.

🔧 Why Tax Mechanic? 🔧 |

|---|

Exclusive Access: Get a dedicated technician and manager. Expertise on Tap: Fraser Simpson with 35+ years dealing with CRA. AI Agents: Cutting-edge support. Community & Strategies: Join a network of tax strategies and shelters. Focused Attention: Personalized service just for you. |

And that's a wrap for this Friday, folks. Have a safe and fun-filled weekend! 🌟🎉 |

UN-Limited Limit Orders in DeFi

CoW Swap limit orders offer:

Unlimited order management: Limit orders on CoW Swap are completely FREE to place or cancel. Yes, really!

Unlimited order placement: Use one crypto balance to place multiple orders at once, even if you don’t have the full amount yet. That’s useful!

Unlimited order surplus: All upside captured after a price is hit goes to you and not to order takers. As it should be!

Plus everything else you know and love about CoW Swap, like gasless trading and MEV protection.